WHY NEXTGEN 529®?

Benefits and Advantages

Higher education can lead to a better job and to better pay. A NextGen 529 account helps you save for your child’s education—and comes with a lot of benefits that can mean more opportunities for your child’s future.

It Pays to Save

It costs money to borrow money. So, every dollar in a NextGen 529 account is a dollar that doesn’t need to be borrowed (and repaid with interest) later.

Contribute What You Want

Set a goal and contribute what you can–even $5 added regularly over time can help. After your first $25 contribution there is no minimum.

You Have Options

None of us know what the future holds, so NextGen 529 accounts are designed to work for you. If your child doesn’t continue education after high school, you can use your funds for something else.

Give a Gift

Anyone can contribute to your NextGen 529 account—parents, grandparents, family, or friends. A contribution to a NextGen 529 account is a great gift idea for birthdays and special holidays.

Leave a Legacy

Contributing to a NextGen 529 account can be an attractive option for grandparents wishing to help fund college for their grandchildren—and provide estate-planning benefits.

Tax-Free Growth

Earnings can grow tax-free from federal (and possibly state) income tax. Withdrawals are federal tax-free when withdrawn to pay for qualified higher education expenses.

Which 529 Account Is Right for You?

NextGen 529 offers three types of accounts

It’s easy to save with NextGen 529

We get it. Saving and paying for higher education can feel complicated and overwhelming. It can be hard to know where and how to start. Using NextGen doesn’t have to be complicated. See how the Martin family from Maine is taking small steps to save for their children’s higher education:

What can I use my NextGen 529 account for?

For College…

Plus a Whole Lot More

No matter where your child’s educational journey takes them, a NextGen 529 account can help them get there.

- Trade School

- Tech School

- Private and Public School

- Apprenticeships

- Home or Abroad

- Online Courses

- Books and Supplies

- Room and Board

- K-12 Tuition*

*While Maine considers K-12 expenses a qualified expense for state tax purposes, other states may treat withdrawals from a 529 for K-12 expenses differently. Please consult your tax advisor for specific advice about such withdrawals.

Maine Taxpayers

Contributions made to a 529 account, of up to $1,000 per student, may be eligible for a Maine state income tax deduction.

Benefits for Maine Residents

It’s Good to Be a Mainer

There’s grant money available for Maine residents.1

$500 Alfond Grant for Maine Babies

A $500 grant toward future higher education expenses for all babies born Maine residents.2

Grants for Maine Residents1

Matching grants can really boost your savings! Grants are available for accounts with either a Maine resident account owner or student (beneficiary).

DID YOU KNOW? Qualified Maine accounts will be rebated any administration fee.

Get Started – Connect or Direct

It’s never too early to start planning. Opening a NextGen 529 account now and saving can make a big difference to your child later. Choose the Account type that’s right for you to get started.

HAVE A QUESTION?

FAQs

Have a question? Get answers to frequently asked questions about NextGen 529 plans. Don’t see your question? Contact NextGen 529.

What can I use a NextGen 529 account for? What’s a qualified expense?

You can use your NextGen 529 account funds to pay for a variety of qualified education expenses1 at eligible higher education institutions, which include four-year colleges or universities, accredited two-year associate degree programs, vocational schools, trade schools, even qualified online courses– any post-secondary schools that participate in federal financial aid programs—at home or abroad. Qualified education expenses generally include expenses such as tuition and fees, computers, books and supplies, and room and board (for students who attend school at least half time).

In addition, NextGen 529 account funds can be used to pay for fees, books, supplies, and equipment required for the participation of a beneficiary in an apprenticeship program registered and certified with the Secretary of Labor under the National Apprenticeship Act. A maximum of $10,000 can be withdrawn to pay for principal or interest on qualified student loans of the designated beneficiary or a sibling of the beneficiary.You can also use up to $10,000 per year for the same beneficiary to pay for K-12 tuition at an eligible elementary or secondary school. While Maine considers K-12 expenses a qualified expense for state tax purposes, other states may treat withdrawals from a 529 for K-12 expenses differently.

What if my child doesn’t go on to higher education?

If your child doesn’t choose higher education (and remember, higher education includes trade and vocational school, two-year programs, and even qualified online courses), you have some choices.

Keep funds for later

Leave it invested! The money you invested can stay in the account. It can still have the opportunity to grow tax-deferred until your child decides to attend college in the future. There is no time limit on when funds must be withdrawn.

Transfer funds to another family member

You can transfer 529 savings to another eligible family member,4 such as a sibling or even yourself. That means you could use it for your own higher education!

Pay student loans

You can pay up to $10,000 for qualified student loans for the beneficiary or their sibling.

Rollover to a Roth IRA

Starting in 2024, you can roll unused funds from your 529 account into a Roth Individual Retirement Account (IRA) for your child, subject to certain limitations..

Withdraw the funds

Withdraw the money and use it however you like. You’ll need to pay taxes and a 10% penalty on any earnings.

The penalty does not apply if the beneficiary receives a scholarship (you can withdraw up to the amount of the scholarship from your account), becomes disabled, or dies and the withdrawal is paid to the beneficiary’s estate.

Is there a minimum amount that I need to contribute?

There is no minimum contribution amount after you open your account with $25. Make contributions when you can, in whatever amount you are able.

Also, if your child received the $500 Alfond Grant, no initial contribution is necessary. Families can use their $500 Alfond Grant to open a NextGen 529 account, without making an initial contribution.

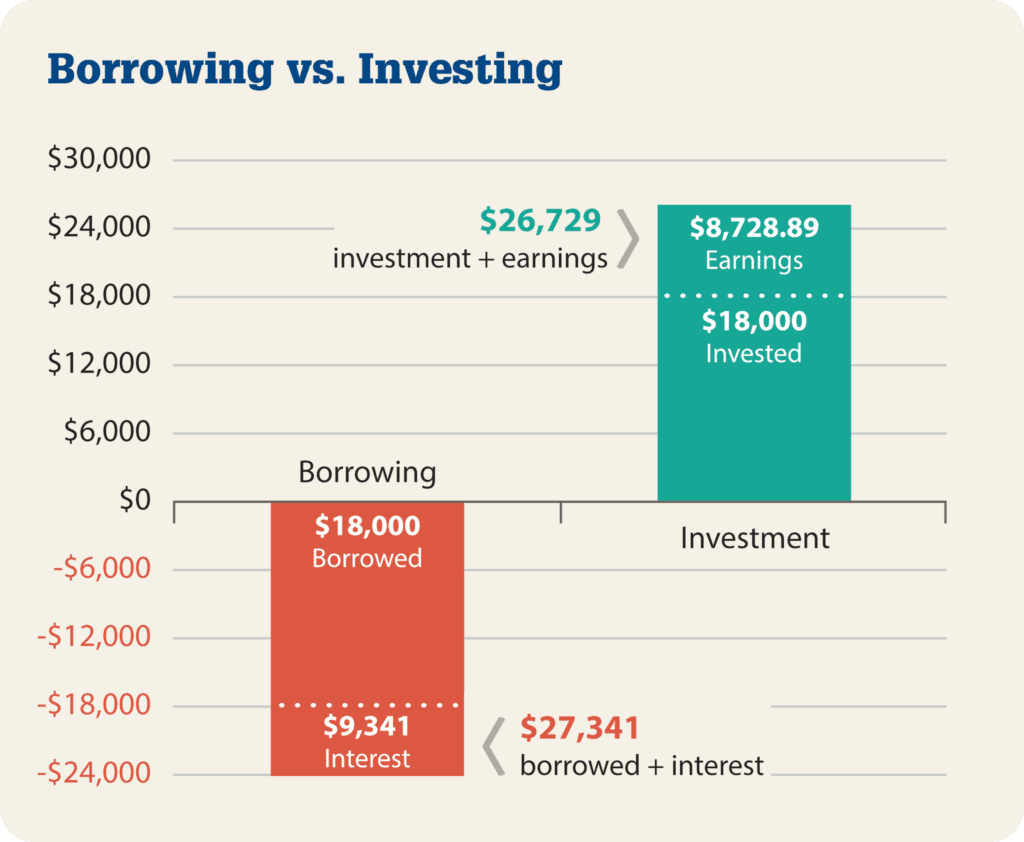

Why does it pay to save?

Every dollar in a NextGen 529 account is a dollar that doesn’t need to be borrowed (and repaid with interest) for education. And that can make a big difference.

Here’s a hypothetical example that illustrates the difference between investing $18,000 and borrowing $18,000.

*This hypothetical investment example illustrates the potential value of regular $100 monthly investments over 15 years and an average annual return of 5%. These examples do not reflect actual investments and do not reflect any fees or expenses. Investment performance is not guaranteed. Investments may lose value.

*This hypothetical borrowing example illustrates the potential cost of borrowing $18,000, repaying over 15 years, and assumes an interest rate of 6%.

Who can open a NextGen 529? Does it have to be a parent?

You don’t have to be the parent or even related to the student. Parents, grandparents and even family friends can open an account, no matter the income or age of the student. You also can open an account to invest for your own future higher education expenses.

Account owners must reside in the United States and be 18 or older, with a valid Social Security number (without work restrictions) or U.S. taxpayer identification number. Noncitizens need to document their United States residency by providing a copy of their United States Permanent Resident Card (commonly known as a “Green Card”) and passport.

What are the tax benefits of NextGen 529 and other 529 plans?

Tax-free growth

Any earnings can grow free from federal and Maine state income tax. Withdrawals, including any earnings, are tax-free when withdrawn to pay for qualified higher education expenses.1 These tax benefits can help maximize your contributions to your 529 account.

Maine state tax deduction

Maine offers a $1,000 Maine income tax deduction on contributions made to NextGen 529 (and any other 529 plan). Tax filers can claim this deduction if their federal adjusted gross income is $100,000 or less if filing single or married filing separately, or $200,000 or less if filing as head of household or married filing jointly.

Other states offer tax deductions.

Gift tax benefits

529 plans also offer federal estate and gift tax benefits, making them a valuable estate-planning tool.

A contribution to a 529 plan account is treated as a completed gift from the giver to the recipient (the designated beneficiary of the 529 account) and qualifies for the annual federal gift tax exclusion of $18,000 ($36,000 for married couples filing jointly), per beneficiary. This allows you to remove assets from your taxable estate while contributing to an account that you control, if you are the account owner.

You may also be able to take advantage of a federal gift tax election that applies only to 529 plan contributions. This allows you to make a lump-sum contribution of up to $90,000 ($180,000 for married couples filing jointly), which is five times the annual exclusion amount, per beneficiary in one year, and treats the contribution as if it was made ratably over five years.3

How do I contribute to a NextGen 529 account?

Contributions can be made online, by check, or by transferring or rolling over funds from another account. You can make it easy by setting up automatic contributions from your checking or savings account, or using payroll deduction.

Contributions are recorded on quarterly account statements that are sent by the account servicer directly to the account owner. Duplicate statements sent to another person can be requested by contacting the account servicer.

Learn more about making contributions to your Connect Account

Learn more about making contributions to your Direct Account

Your financial advisor can help you with contributions to your Select Account.

Can my child access funds in the account?

No. As the account owner of an individual NextGen 529 account, you retain control of the account. Only you can instruct how and when withdrawals are made from the account.

What is the Maine Administration Fee Rebate Program?

If either the NextGen 529 account owner or beneficiary is a Maine resident, any Maine Administration Fee paid during the year will be automatically rebated the following year. To qualify, on the last business day of the calendar year the account must have a balance of at least $1,000 and must be invested in a Portfolio subject to the Maine Administration Fee. The minimum rebated amount is $2.00; amounts less than $2.00 will not be paid. See the Program Description for your plan for full details.

How do I make a withdrawal from my NextGen 529 account?

There are a number of ways to make a withdrawal–you can request a check, transfer funds to your bank account, or even send funds directly to a school. Your financial advisor can help you with a withdrawal from your Select Account.

Learn more about making withdrawals from your Direct Account

Learn more about making withdrawals from your Connect Account

COLLEGE SAVINGS GUIDE

Planning Now Gives Your Child More Choices Later

Education after high school can open a world of possibility for you or your child. It can also seem a little overwhelming at times. To help you get started, we’ve written some articles that can help you learn about saving and paying for education after high school—and how to give your child more options for a brighter future.

1 Grants for Maine Residents are linked to eligible Maine accounts. An Alfond Grant recipient is eligible to receive the $100 Initial Matching Grant if the minimum required initial contribution is made before the beneficiary’s first birthday. Upon withdrawal, grants are paid only to institutions of higher education. See Terms and Conditions of Maine Grant Programs for other conditions and restrictions that apply. Grants may lose value.

2 The Alfond Grant is not automatic in all circumstances and is also available in limited other circumstances. The use of the Alfond Grant is also subject to certain restrictions – see Alfond Grant Guidelines.

3 To be eligible for favorable tax treatment afforded to any earnings portion of withdrawals from Section 529 accounts, such withdrawals must be used for qualified higher education expenses, as defined in Section 529 of the Internal Revenue Code. Any earnings withdrawn that are not used for qualified higher education expenses are subject to federal income tax and may be subject to a 10% additional federal tax as well as state and local income taxes. State tax treatment of distributions for certain qualified higher education expenses may differ. Please consult your tax advisor for specific advice regarding such distributions.

4 Some restrictions apply. You generally are permitted to change the beneficiary to another qualified member of the family, as defined under the Internal Revenue Code, without triggering income tax and 10% additional federal tax. Not applicable for accounts opened under a Uniform Gifts/Transfers to Minors Act registration.

5 If you make the five-year election to prorate a lump-sum contribution that exceeds the annual federal gift tax exclusion amount and you die before the end of the five-year period, the amounts allocated to the years after your death will be included in your gross estate for tax purposes. Please consult your tax and/or legal advisor for specific guidance before making investment decisions that could affect your taxes or estate or Medicaid planning needs.

USRRMH1024U/S-3947310