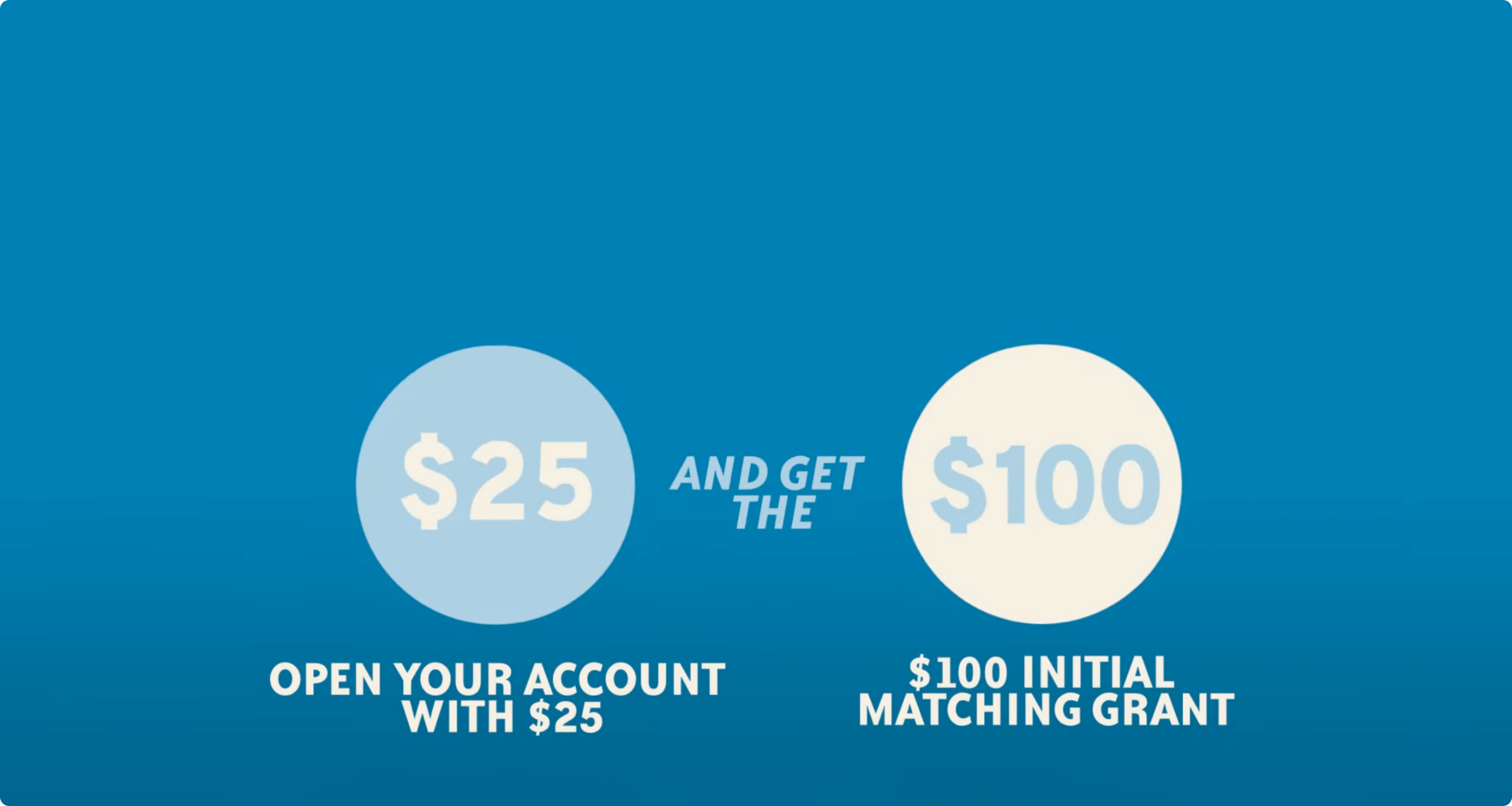

$100 Initial Matching Grant

Get the $100 Initial Matching Grant when you open a NextGen 529 account and add $25.

The Initial Matching Grant is available for accounts with either a Maine resident account owner or student (beneficiary).

What do I do?

How It Works

Receiving the $100 Initial Matching Grant is as easy as 1-2-3.

2. GET $100 AUTOMATICALLY

The $100 Initial Matching Grant will be awarded to you automatically by the Finance Authority of Maine (FAME).

3. RECEIVE NOTIFICATION

FAME will send you a letter telling you that you’ve received the grant. It’s as easy as that!

An Alfond Grant recipient baby can get the $100 Initial Matching Grant when a NextGen 529 account is opened and a $25 contribution is made before the baby’s first birthday.

What else?

What to Know

The Initial Matching Grant is limited to one per beneficiary and can only be awarded once. All Grants for Maine Residents awarded by FAME can only be used at institutions of higher education that are eligible for federal financial aid. And when it’s time for your student to go to school, grant funds (including any earnings) can only be paid directly to your student’s school.

- Grants (including any earnings) can’t be transferred to another beneficiary.

- Although grants will appear on your NextGen 529 account statement, they (and any earnings) remain the property of FAME until they are paid directly to your student’s school.

- Grants are invested at the discretion of FAME.

- FAME invests grants in a Matching Grant Portfolio in one of two age bands (0-15 years and 16+ years) based on the age of the student (beneficiary).

- Investments involve risk. Grants for Maine Residents may lose value.

View the Terms and Conditions of Maine Grant Programs for other conditions and restrictions that apply.

Which 529 Account Is Right for You?

NextGen 529 offers three types of accounts

Get Started – Connect or Direct

It’s never too early to start planning. Opening a NextGen 529 account now and saving can make a big difference to your child later. Choose the Account type that’s right for you to get started.

USRRMH1024U/S-3947341