Automated Funding Grant

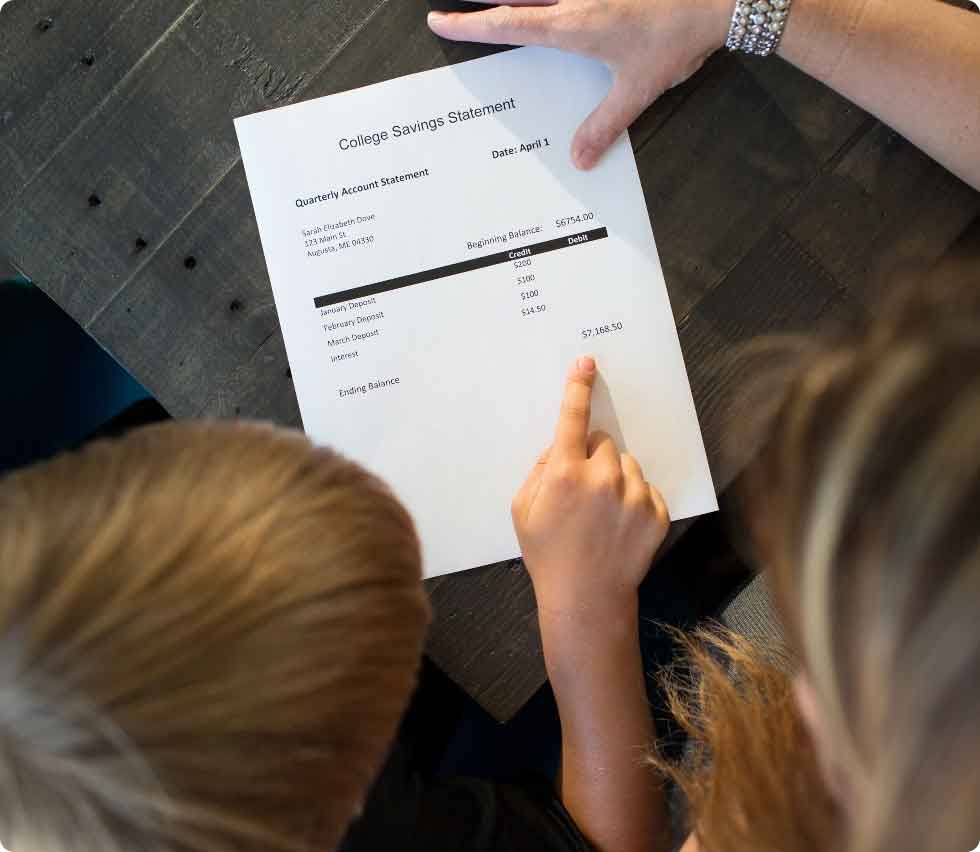

Get the one-time $100 Automated Funding Grant when you set up and make six consecutive automatic contributions to your NextGen 529 account.

The Automated Funding Grant is available for accounts with either a Maine resident account owner or student (beneficiary).

What do I do?

How It Works

Receiving the Automated Funding Grant is as easy as 1-2-3.

SET UP AUTOMATIC CONTRIBUTIONS

Set up automatic contributions to your NextGen 529 account from your payroll or bank account.

MAKE SIX CONSECUTIVE CONTRIBUTIONS

Contribute six times in a row, at least every three months (quarterly).

RECEIVE AWARD NOTIFICATION

FAME will send you a letter telling you that you’ve received the grant. It’s as easy as that!

What else?

What to Know

The Automated Funding Grant is limited to one per beneficiary and can only be awarded once. All Grants for Maine Residents awarded by FAME can only be used at institutions of higher education that are eligible for federal financial aid. And when it’s time for your student to go to school, grant funds (including any earnings) can only be paid directly to your student’s school.

- Grants (including any earnings) can’t be transferred to another beneficiary.

- Although grants will appear on your NextGen 529 account statement, they (and any earnings) remain the property of FAME until they are paid directly to your student’s school.

- Grants are invested at the discretion of FAME.

- FAME invests grants in a Matching Grant Portfolio in one of two age bands (0-15 years and 16+ years) based on the age of the student (beneficiary).

- Investments involve risk. Grants for Maine Residents may lose value.

View the Terms and Conditions of Maine Grant Programs for other conditions and restrictions that apply.

Get started

Set Up Automated Contributions

Log in to your account to set up automated contributions online. Remember to set your contribution frequency to at least quarterly to be eligible for the Automated Funding Grant.

More Information About Automated Contributions

Select Account owner? Contact your financial advisor to set up automated funding.

Which 529 Account Is Right for You?

NextGen 529 offers three types of accounts

USRRMH1024U/S-3947341