Give the Gift That Lasts a Lifetime

Toys get tossed, video games are easily forgotten, and trends are temporary. But education? That’s the gift that truly lasts. NextGen 529 gift cards make fantastic holiday, birthday, or “just because” gifts.

HOW TO BUY A CARD

- Buy a NextGen 529 gift card at CVS stores throughout Maine.

- Buy a gift card online at GiftofCollege.com.

Wrap your gift card, put it in an envelope, or hand it to your special child with a hug!

GOT A CARD?

How to Redeem a Gift Card

If someone’s given you or your student a Gift of College gift card, redeem it into your NextGen 529 account by creating a profile at GiftofCollege.com and linking your NextGen 529 account.

Already have a NextGen 529 account?

Follow these steps to redeem your gift card at the Gift of College website:

- Visit GiftofCollege.com and sign up. You will create a Gift of College profile–this is free and quick. See the FAQ below for more information about your profile.

- Link your NextGen 529 account. Once you have an account and are logged into your Gift of College profile, you can link a 529 account within the Savings Plans and Student Loans tab. Add the account owner’s name, account number, and beneficiary (student) of the NextGen 529 account.

You can link more than one account to your Gift of College profile if you have multiple accounts for multiple children. - Redeem: On your Member Profile page, choose “Redeem” and the 529 account you want to add the gift card to. Enter the Gift Code printed on your gift card.

The gift card value will be applied to your NextGen 529 plan within 14 business days.

Don’t yet have a NextGen 529 account?

If you or your student doesn’t already have a NextGen 529 account, you can open a Direct account online, or a Select account with your financial advisor.

HAVE A QUESTION?

FAQs

Have a question? Get answers to frequently asked questions about NextGen 529 plans. Don’t see your question? Contact NextGen 529.

What can I use a NextGen 529 account for? What’s a qualified expense?

A NextGen 529 account can be used for college…plus a whole lot more! No matter where your child’s educational journey takes them, a NextGen 529 account can help them get there. Use it to pay for all kinds of education at home and abroad.

You can use your NextGen 529 account funds to pay for a variety of qualified education expenses1 at eligible higher education institutions, which include four-year colleges or universities, accredited two-year associate degree programs, vocational schools, trade schools, even qualified online courses– any post-secondary schools that participate in federal financial aid programs—at home or abroad. Qualified education expenses generally include expenses such as tuition and fees, computers, books and supplies, and room and board (for students who attend school at least half-time).

In addition, NextGen 529 account funds can be used to pay for fees, books, supplies, and equipment required for the participation of a beneficiary in an apprenticeship program registered and certified with the Secretary of Labor under the National Apprenticeship Act. A maximum of $10,000 can be withdrawn to pay for principal or interest on qualified student loans of the designated beneficiary or a sibling of the beneficiary.

You can also use up to $10,000 per year for the same beneficiary to pay for K-12 tuition at an eligible elementary or secondary school (although some states still consider K-12 tuition a non-qualified expense).

Who can open a NextGen 529? Does it have to be a parent?

You don’t have to be the parent or even related to the student. Parents, grandparents and even family friends can open an account, no matter the income or age of the student. You also can open an account to invest for your own future higher education expenses.

Account owners must reside in the United States and be 18 or older, with a valid Social Security number (without work restrictions) or U.S. taxpayer identification number. Noncitizens need to document their United States residency by providing a copy of their United States Permanent Resident Card (commonly known as a “Green Card”) and passport.

What are the tax benefits of NextGen 529 and other 529 plans?

Tax-free growth

Any earnings can grow free from federal and Maine state income tax. Withdrawals, including any earnings, are tax-free when withdrawn to pay for qualified higher education expenses.1 These tax benefits can help maximize your contributions to your 529 account.

Maine state tax deduction

Maine offers a $1,000 Maine income tax deduction on contributions made to NextGen 529 (and any other 529 plan). Tax filers can claim this deduction if their federal adjusted gross income is $100,000 or less if filing single or married filing separately, or $200,000 or less if filing as head of household or married filing jointly.

Other states offer tax deductions. Learn more at finaid.org

Gift tax benefits

529 plans also offer federal estate and gift tax benefits, making them a valuable estate-planning tool.

A contribution to a 529 plan account is treated as a completed gift from the giver to the recipient (the designated beneficiary of the 529 account) and qualifies for the annual federal gift tax exclusion of $18,000 ($36,000 for married couples filing jointly), per beneficiary. This allows you to remove assets from your taxable estate while contributing to an account that you control, if you are the account owner.

You may also be able to take advantage of a federal gift tax election that applies only to 529 plan contributions. This allows you to make a lump-sum contribution of up to $90,000 ($180,000 for married couples filing jointly), which is five times the annual exclusion amount, per beneficiary in one year, and treats the contribution as if it was made ratably over five years.2

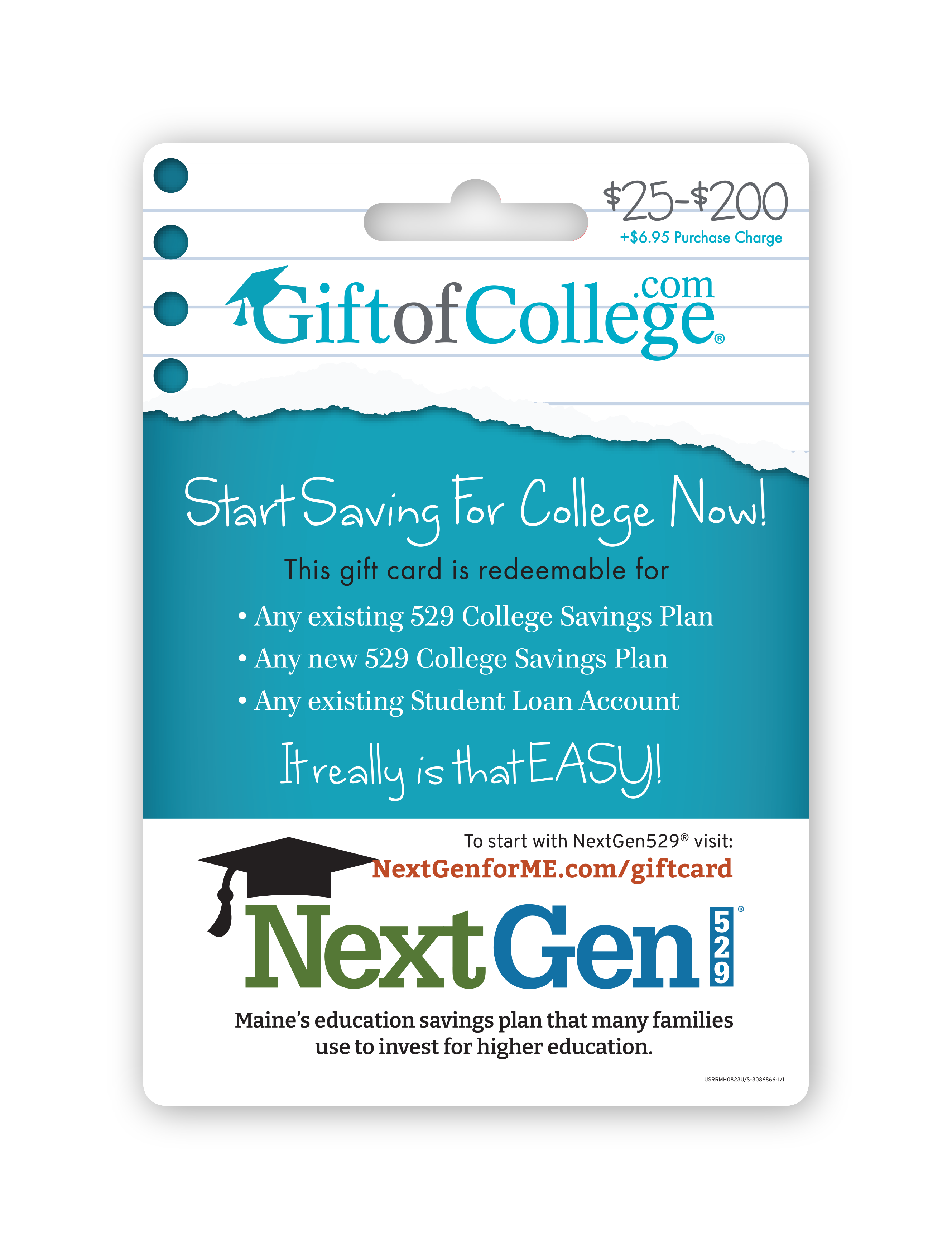

What is the Gift of College gift card?

Gift of College gift cards are a great way to get a special student in your life started with college savings. It’s also a meaningful way to acknowledge a birth or adoption, celebrate a birthday or graduation, or simply give as a just-because gift!3

Gift cards are available to purchase online at giftofcollege.com and at participating stores nationwide. You can also buy NextGen 529-branded Gift of College gift cards at CVS stores in Maine. Find a store near you at the Gift of College website.

Giftofcollege.com is an online gift platform where 529 account owners can create a gift registry for their student and link it to their 529 account. Gift card recipients can use this online gift platform to redeem their gift cards into their 529 account. Gift of College can also facilitate gift contributions to a student loan account.

Where and how can I buy Gift of College cards?

Gift of College Gift cards are available to purchase online at giftofcollege.com and at participating stores nationwide. You can also buy NextGen 529-branded Gift of College gift cards at CVS stores in Maine. Find a store near you at the Gift of College website.

Why do I need a Gift of College Profile?

Setting up a Gift of College profile online is quick and easy (and free)! You can link more than one NextGen 529 account to your profile if you have multiple accounts for each of your children or grandchildren. Once you have the profile set up, you can redeem gift cards into a linked account.

You’ll need some basic information about yourself: your phone number, email address, and mailing address. You’ll also need information about any NextGen 529 accounts you want to link to your profile: the account owner name, beneficiary (student) name, plan information (listed by state), and the account number

Having a profile allows you to add gifts to your 529 account and invite friends and family to make contributions electronically (without having to share your account number). Having a profile also helps ensure that your gift card is added to your account without errors.

Do Gift of College cards expire?

No. There’s no expiration date on Gift of College cards.

Is there a fee for the Gift of College card?

It is free to create a profile at Gift of College and connect your NextGen 529 account. The recipient of a gift card does not have to pay any fees. The gift card recipient receives the full face-value of the card.

Similar to fees charged for other gift cards, there is a fee when a Gift of College Gift card is purchased.

In CVS stores:

$6.95 + gift card

Online:

$3.95 for a $25+ gift card

$4.95 for a $50+ gift card

$5.95 for a $100+ gift card

Does a Gift of College card qualify for Maine Matching Grants?

When the Gift of College amount is redeemed into a NextGen 529 account, the contribution is treated like any other contribution to a NextGen 529 account and may be eligible to be matched with the Grants for Maine Residents program. Learn more about eligibility here.

Can a Gift of College card be used for student loan repayment?

Gift of College gift cards can also be used for student loan repayment when the card is redeemed into a student loan account at the Gift of College site.

1 To be eligible for favorable tax treatment afforded to any earnings portion of withdrawals from Section 529 accounts, such withdrawals must be used for qualified higher education expenses, as defined in Section 529 of the Internal Revenue Code. Any earnings withdrawn that are not used for qualified higher education expenses are subject to federal income tax and may be subject to a 10% additional federal tax, as well as to state and local income taxes. State tax treatment of distributions for certain qualified education expenses may differ. Please consult your tax advisor for specific advice regarding such distributions.

2 If you make the five-year election to prorate a lump-sum contribution that exceeds the annual federal gift tax exclusion amount and you die before the end of the five-year period, the amounts allocated to the years after your death will be included in your gross estate for tax purposes. Please consult your tax and/or legal advisor for specific guidance before making investment decisions that could affect your taxes or estate or Medicaid planning needs.

3 Third-party contributions: Persons other than the account owner who make contributions will have no subsequent control over the funds contributed to a NextGen 529 account. Only the NextGen 529 account owner will receive confirmation of account transactions and may direct transfers, rollovers, investment changes, withdrawals and change the account beneficiary (as permitted under federal law). Third-party contributors may subject NextGen 529 account owners to tax consequences. NextGen 529 account owners and third-party contributors should consult their tax advisors to discuss income or gift tax consequences.

USRRMH1024U/S-3948830