What’s a Connect Account?

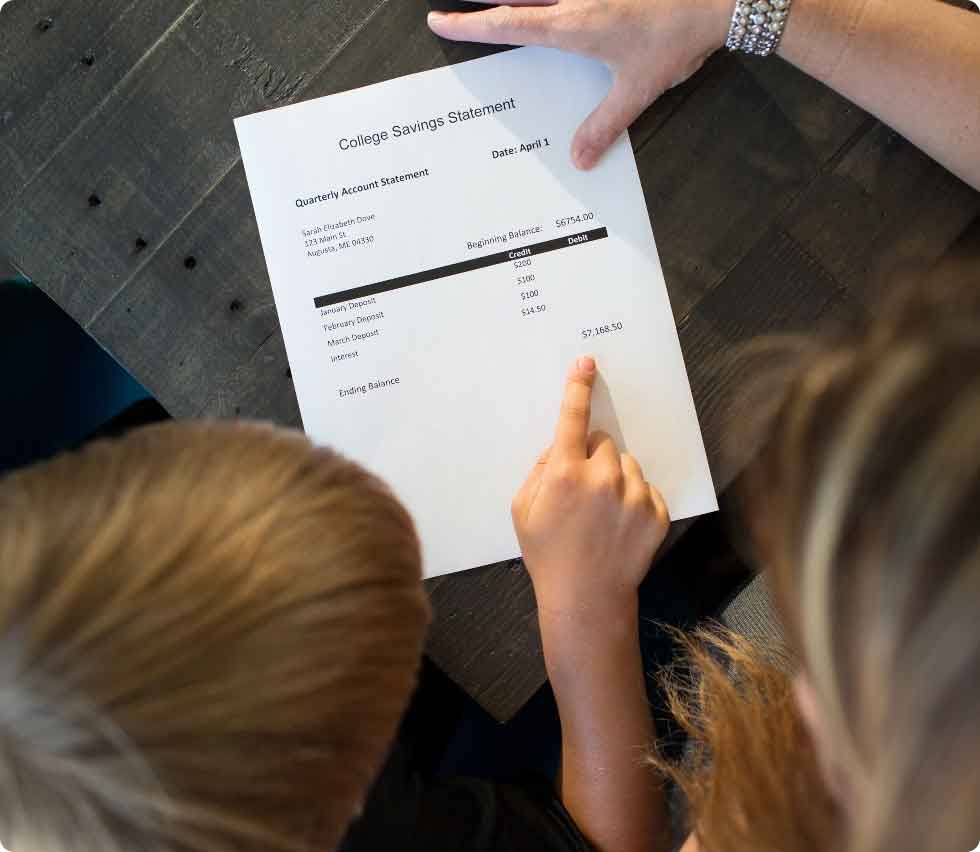

A NextGen 529 Connect Account is for people who are ready to save for higher education and want a simplified approach with fewer investment options to choose from. After you open a Connect Account, you have the option to open a separate savings account, through Vestwell, to help you build emergency (or other) savings.1

Already have a NextGen 529 Connect account?

You can also download the mobile app from the App Store or Google Play.

Connect Account Investment Options

A Connect Account offers a Year of Enrollment investment option. Year of Enrollment portfolios move from higher risk to more conservative options automatically as your student ages/gets closer to enrollment to protect your investment.

When you open a Connect Account, you enter the age you expect your student will be when they will start using the money. Based on the age you enter, you will be presented with the portfolio that best corresponds to the year your student will start using their funds. You can confirm that choice or select a different option.

After your account is opened, you can change your investment option to another portfolio or to the NextGen Savings Portfolio. The NextGen Savings Portfolio is invested in a bank deposit account, currently with Fifth Third Bank. Amounts deposited in the NextGen Savings Portfolio are eligible for FDIC insurance.

The current rate of the NextGen Savings Portfolio is 4.34% APY as of April 1, 2025.

For more information about Connect Account investment options:

Connect Account Fees and Charges

Fees range from 0% to .29% of a portfolio’s average annual net asset value.

- Other fees and charges may apply.

- Fund expenses can change, affecting total annual asset-based fees.

For complete information regarding Program Fees and underlying fund expenses, review the Connect Program Description.

Connect Account Performance

Like any investment, performance can rise or fall. For more information about the past performance of each investment option, get the Connect Account performance chart.

Would You Also Like to Build Emergency Savings?

After you open a Connect Account, you have the option to open a separate savings account, through Vestwell, to help you build emergency savings. This emergency savings account does not enjoy the same tax benefits as a 529 account but does allow you to withdraw your savings without incurring a penalty for a non-qualified withdrawal1.

CUSTOMER SUPPORT

We’re Here to Help

Whether you have a question about opening a NextGen 529 account or just want to talk with someone to make sure it’s right for you, we can help.

- Contact the NextGen 529 call center at 1-833-33-NG529 (1-833-336-4529).

- Looking for an account servicing form?

Visit the NextGen 529 Connect Forms page - Have questions about the $500 Alfond Grant or Grants for Maine Residents? Call FAME at 800-228-3734.

- You can request distributions, make investment changes and contribute online. Log in to account.

GRANTS FOR MAINE RESIDENTS

It’s Good to Be a Mainer

There’s grant money available for Maine residents. These grant programs can really boost your savings.2

$500 Alfond Grant for Maine Babies

$100 Initial Matching Grant

$100 Automated Funding Grant

30% NextStep Matching Grant

Open a NextGen 529 Connect Account

It’s never too early to start planning. Opening a NextGen 529 Connect account now and saving can make a big difference to your child later.

1 The Emergency Savings Account (ESA) is not part of the NextGen 529 Program, not entitled to the tax advantages available to Participants invested in the NextGen 529 Program, and not affiliated with FAME. All deposits in the ESA are subject to terms and conditions separate and apart from the terms and conditions that govern the NextGen 529 Program. Neither the NextGen 529 Program nor FAME guarantees or insures any deposits in the ESA.

2Grants for Maine Residents are linked to eligible Maine accounts. An Alfond Grant recipient is eligible to receive the $100 Initial Matching Grant if the minimum required initial contribution is made before the beneficiary’s first birthday. Upon withdrawal, grants are paid only to institutions of higher education. See Terms and Conditions of Maine Grant Programs for other conditions and restrictions that apply. Grants may lose value.

3The Alfond Grant is not automatic in all circumstances and is also available in limited other circumstances. The use of the Alfond Grant is also subject to certain restrictions – see Alfond Grant Guidelines.

USRRMH1224U/S-4113934