COLLEGE SAVINGS GUIDE ARTICLES:

What Is a 529 plan?

Whether you have a newborn, middle schooler, or high school student, or you’re planning to continue your own education, saving for college is an important step to getting ready for education after high school. Most families pay for college through a variety of sources—savings, scholarships, income, to name a few.

One of the tools many families use to help pay for college is an investment plan called a 529 plan. In this article, we’ll take you through the ins and outs of 529s to help you decide if it is something that’s right for you and your family.

So, What Is a 529 College Savings Plan?

A Section 529 college savings account is an investment account primarily designed to help families save for higher education. They’re called 529 plans because they’re described in Section 529 of the U.S. Internal Revenue Code.

529 plans can be used to pay for costs associated with college, K-12 tuition (up to $10,000 per year), apprenticeship programs, and student loan repayments (up to $10,000 for a designated beneficiary or their siblings).

529 plans are sponsored by states or state agencies, and nearly every state in the U.S. offers one. You don’t have to use your home state’s plan, but there may be tax or other benefits if you do!

529 College Savings Plan Tax Benefits

One of the great things about 529 plans is that they offer special tax benefits. Earnings saved in a 529 account are federal tax-free when they’re used for qualified higher education expenses1 at eligible institutions.

Qualified education expenses include:

- Tuition

- Fees

- Computers

- Books and supplies

- Room and board (for students who attend school at least half time)

Eligible institutions are those educational institutions that participate in federal financial aid programs. There are eligible schools in the United States and overseas. Here are some of the types of schools that are eligible institutions:

- Two-year colleges (often community colleges)

- Four-year colleges and universities (public and private)

- Trade or career schools

- Some online schools

Because after-tax dollars are used to fund a 529 account, contributions are not deductible for federal tax purposes. Some states, however, do offer state tax benefits for contributions to Section 529 plans.

529 Plan Terminology

You’ll find the following terminology useful in understanding 529 plans:

Account Owner/Participant

The account owner, also called the participant, is the person who owns the 529 account. Most 529 plan accounts can be owned by only one person. The account owner is often a parent, but accounts can also be owned by grandparents, other family members, and even family friends. An adult can also own an account for themselves. The account owner controls the account, deciding how the money is invested and when and for what the money is withdrawn.

Beneficiary

The designated beneficiary is the person benefiting from the money saved in a 529 account. The beneficiary is often a child, but it can also be an adult student saving for a return to school or further training. (In this case, the account owner and the beneficiary can be the same person.)

If a beneficiary doesn’t go on to higher education or use all the money in their account, the account owner can change the designated beneficiary to another family member or themselves.

Contributions

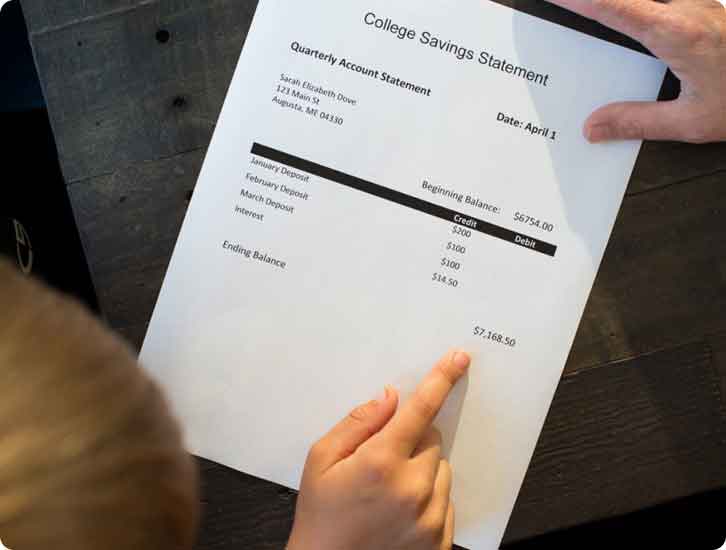

Money added to a 529 account is typically called a contribution rather than a deposit. Contributions can be made whenever an account owner can afford to add money or, more regularly, using an automated method. Automated contributions can be made from payroll or from a bank or savings account. (Many people find contributing automatically makes it easy to add to the account.)

Family and friends can also contribute to an account. Each 529 plan provides options for gifting.

Investment Options

When you open a 529 account, you will be asked to choose how any money you add to your account will be invested. The options available are based on the 529 plan you choose. You’ll only be able to change how your money is invested twice a year.

Withdrawals/Distributions

The account owner can make withdrawals (also called distributions) to pay for qualified higher education expenses. Withdrawals used for qualified higher education expenses are tax-free.

When it’s time to make a withdrawal, the account owner decides how much to withdraw and how they want to receive the funds. Funds in a 529 account can be paid to the eligible higher education institution, directly to the account owner, or to the designated beneficiary.

Maine’s 529 Plan

Maine has its own 529 plan called NextGen 529. It’s administered by the Finance Authority of Maine (FAME). Many Maine families use a NextGen 529 account to save for higher education.

You can open and fund a new NextGen 529 account with $25; however, that initial contribution is waived if you sign up for automated funding when you open an account. There is no minimum contribution amount for contributions made to a NextGen 529 account after the initial $25 has been contributed. Even adding $5.00 a month to a NextGen 529 account can help!

NextGen 529’s maximum contribution limit is generous—$545,000 per all NextGen 529 accounts for the same beneficiary.

Investment Options

With NextGen 529, you can either work with a financial advisor or direct your own investments.

For an account you manage yourself, choose the Connect Account or Direct Account; if you prefer to work with a financial advisor, choose the Select Account.2

NextGen 529 offers a number of investment options, such as:

- Year of Enrollment options (funds are invested most aggressively when the student is further from enrollment and are automatically shifted to more conservative investments as the child gets closer to using the funds.)

- Diversified options (each portfolio is invested in a combination of underlying funds)

- Single-fund options (each portfolio is invested in one underlying fund)

- Stable value (each portfolio strives to retain principal)

Grants for Maine Residents

Maine’s generous matching grant program3 gives Mainers another reason for saving with a NextGen 529 account. There are hundreds of dollars available each year.

Matching grants are available for accounts owned by a Maine resident or for a Maine beneficiary. Grants are limited to one per beneficiary.

Here are some of the grants available:

$100 Initial Matching Grant

When you open an account with a contribution of $25 or more, you’ll receive a $100 Initial Matching Grant.

Have a baby with a $500 Alfond Grant? Open your account, add $25 before your baby’s first birthday and get the $100 Initial Matching Grant. This grant is limited to accounts opened before a baby turns one to encourage families to start saving early.

30% NextStep Matching Grant

By contributing to your child’s NextGen 529 account each year, you’ll receive a 30% NextStep Matching Grant up to $300. For example:

- Add $100 in a year and get a $30 grant

- Add $500 in a year and get a $150 grant

- Add $1,000 in a year and get the maximum $300 grant

$100 Automated Funding Grant

Make saving easy by setting up automatic contributions from your payroll or bank account.

- Make six automatic contributions consecutively and get a $100 Automated Funding Grant

The Bottom Line

A 529 plan account is an investment account primarily designed to help families save for higher education. Maine has its own 529 plan called NextGen 529, which many Maine families use to get ready for education after high school. It’s easy to open and fund an account—especially if you take advantage of Maine’s generous matching grant program. Learn more about Connect Accounts and Direct Accounts.

- To be eligible for favorable tax treatment afforded to any earnings portion of withdrawals from Section 529 accounts, such withdrawals must be used for qualified higher education expenses, as defined in Section 529 of the Internal Revenue Code. Any earnings withdrawn that are not used for qualified higher education expenses are subject to federal income tax and may be subject to a 10% additional federal tax as well as state and local income taxes. State tax treatment of distributions for certain qualified higher education expenses may differ. Please consult your tax advisor for specific advice regarding such distributions.

- Each series offers different investment options with its own sales charges, fees and expense structure. Some of the same investment options are available in each series.

- Grants for Maine residents are linked to eligible Maine accounts. Upon withdrawal, grants are paid only to institutions of higher education. See Terms and Conditions of Maine Grant Programs for details about eligibility and other conditions and restrictions that apply. Grants may lose value.

Related Articles

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

APPLYING FOR FINANCIAL AID

Many families pay for education after high school by pulling from a variety of sources, and financial aid is an important part of that. This guide will help you through the application process.

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

Essential Calculators and Tools

Whether you’d like to see what your tax savings advantages could be with a NextGen 529 or how much you should save for your child’s college education, these tools will help.

USRRMH1024U/S-3947293