COLLEGE SAVINGS GUIDE ARTICLES:

Goals-Based Budgeting Can Help You Reach Your Savings Goals

You can start with just one small step!

Housing, groceries, student loans, daycare, transportation …with so many financial commitments, it can be hard to find money to save for emergencies, retirement, and higher education. A great way to reach financial goals is to assign monthly income. Break out your monthly income into non-negotiables, like to have, and goals. Once you know what you’re working with, it makes it easier to plan. Just remember: you don’t have to reach all your goals at once, just take it one step (or month) at a time.

How to Break Down Your Monthly Pay

Begin by figuring out what you’re working with. Take a look below for an example of what to do.

Your Monthly Starting Point:

→ Example: $6000/mo

- Add up your take home pay for a month. If you have pay that varies (for example with tips or hours that flex- track), add up your pay each week for 30 days to create a monthly average.

Your “Have Tos”:

→ Example: $5260/mo

- Subtract necessities, such as: Housing, Transportation, Utilities, Childcare, Insurance, Groceries

- Add in the existing financial commitments, like: Phone, Internet, Minimum credit card payment, Minimum student loan payment

- Don’t forget estimates for extras like going out, clothing, gifts

Your Commitment to Savings and Pay Down Goals:

→ Example $740/mo

- Identify the financial milestones that mean the most to you and reflect your unique situation. The amounts and timeframes must be reasonable for what you have.

→ Here are some sample savings goals and how to reach them over time:

SAVINGS GOALS

| Total | Approximate Timeframe (Years) | Monthly | |

|---|---|---|---|

| Emergency savings* | $5,000 | 1 | $417 |

| Education savings* | $20,000 | 15 | $111 |

| Retirement | $40,000 | 10 | $350 |

| Down payment | $15,000 | 5 | $250 |

PAY DOWN GOALS

| Total | Approximate Timeframe (Years) | Monthly | |

|---|---|---|---|

| Student loan | $10,000 | 10 | $100 |

| Credit cards* | $5,000 | 4 | $210 |

Now what? Prioritize.

Now that you have an idea of your goals, it’s time to set a plan to work toward your top priorities. Based on your monthly income and the money you need for your non-negotiables, you have $740/month to allocate to your savings goals. Let’s take a look at how that might play out.

| Priority 1: Emergency Savings | This one is the top dog. This fund will keep you afloat when those unexpected/unplanned expenses blindside you. Without this fund, you might take on more high-interest debt that grows and pushes you further from your goals. | $417/month for the first year After year 1, you can re-allocate this $400 payment to a new priority— maybe a down payment for the house. |

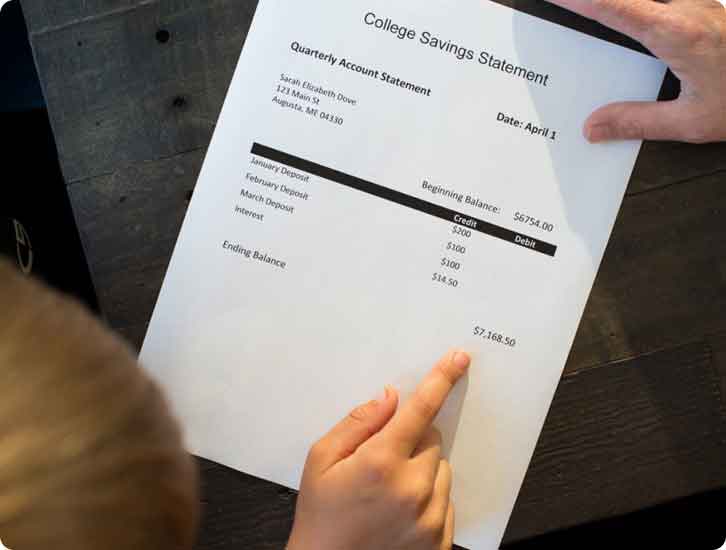

| Priority 2: Education Savings | Your little ones grow fast! There is only a short time to save, so get going early and let the benefits of compounded earnings help you to achieve your total savings goal. | $111/month As your necessities change (no more diapers, no more all-day child care) you can add those funds to this account. You can also add gifts from family and friends to get an extra boost. Once you have met your goal, re-allocate to another priority—maybe retirement. |

| Priority 3: Credit card paydown | Paying to use other people’s money is expensive. Reduce the amount that you owe until you can pay off the amount borrowed every single month. Then, you can use your credit account interest-free. | $210/month. Don’t add any new debt, so the outstanding balance will be $0 in 2 years. If you keep the discretionary spending in check and pay the balance of the card in full, you may want to add a new goal. How about $200/month towards a new vehicle! |

| Priority 4: Student Loan Repayment | You already included this payment in your Monthly Have Tos, but there may be repayment options that reduce the amount you need to pay each month allowing you to use some funds for other priorities. Check with your student loan servicer about Public Service Loan Forgiveness, Income-Driven Repayment, Consolidation, or Refinancing to determine which option may be right for you. |

Your plan is within budget at $738/month and you have identified steps to move to your next set of goals.

Sticking to a budget can be tough, but there are a number of resources available to help you get started and stay on track. Here are a few tips:

- Track your spending: Awareness is the first step to taking control of your finances. There are a number of budgeting tools available, such as YNAB (You Need a Budget). You can also create a simple spreadsheet to track your income and expenses. Keeping receipts for three months can be an eye-opening experience and help you identify areas where you can cut back.

- Automate your finances: Set up automatic transfers to your savings account and to pay your bills on time. This will help you avoid late fees and make sure you are consistently saving towards your goals.

- Reward yourself: Sticking to a budget takes work, so it’s important to reward yourself for your consistency. Choose rewards that don’t blow your budget, like a night hanging with friends or a walk on the beach.

- Develop a support system: Listen to podcasts, talk to others about your financial goals. Having a support network can be a great motivator.

- Pay off high-interest debt: High-interest debt like payday loans and credit cards can quickly derail your financial progress. Focus on paying off these debts first.

- Plan for regular expenses: Factor in costs like car maintenance, annual subscriptions and holiday gifts into your budget.

- Take advantage of your tax refund: Consider putting your tax refund towards your savings goals.

→ By following these tips, you can take control of your finances and achieve your financial goals. You got this!

Related Articles

PLANNING FOR COLLEGE

College planning can be super exciting for young people dreaming about what they’ll do with their lives. It can also be a little overwhelming and stressful.

READ MORE ›

COLLEGE SAVINGS OPTIONS

From savings accounts to savings bonds to 529 plans, there are a variety of ways families save for college. Learn about the different ways to save for college.

EXPLORE OPTIONS ›

PAYING FOR COLLEGE

Paying for college is typically the first big financial decision a young person makes in their lifetime. This guide will help your family figure out how to pay for college.

READ MORE ›

Essential Calculators and Tools

Whether you’d like to see what your tax savings advantages could be with a NextGen 529 or how much you should save for your child’s college education, these tools will help.

USRRMH1224U/S-4114116